LIABILITIES

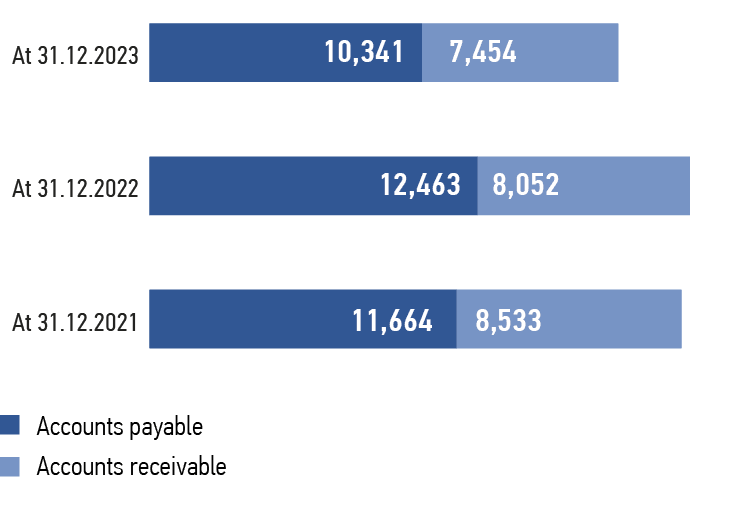

The results for 2023 show a decrease in accounts receivable and accounts payable.

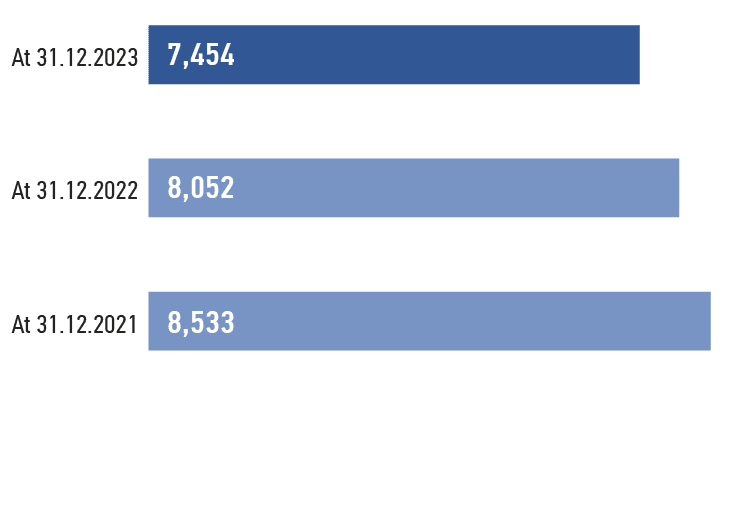

ACCOUNTS RECEIVABLE

IndicatorMetrics are aligned with financial statements of the Company for the reporting period. | As of 31.12.2023 | As of 31.12.2022 | As of 31.12.2021 |

|---|---|---|---|

Accounts receivable, including: | 7,454 | 8,052 | 8,533 |

Trade receivables | 5,416 | 6,357 | 6,772 |

including for electricity transmission | 5,220 | 5,949 | 6,441 |

Bills receivable | 0 | 0 | 0 |

Advances paid | 43 | 27 | 48 |

Other accounts receivable | 1,995 | 1,668 | 1,713 |

The total amount of accounts receivable of PJSC Rosseti South at the end of the reporting period was RUB 7,454 million, and as of 31 December

The Company works to reduce receivables for electricity transmission services in accordance with the provisions of the Regulations for Handling Receivables for Electricity Transmission Services on the Balance Sheet of PJSC Rosseti South approved by the Company’s Order No. 594 dated 3 October 2023.

As a result of the Company’s efforts to collect overdue receivables for electricity transmission services in the reporting year, positive court decisions were passed in 259 court cases totalling RUB 1,159.6 million, with RUB 11.6 million denied in eight cases. The share of claims satisfied in favour of the Company was 92%, which is higher than in the previous year.

During the preceding reporting year, positive court rulings were made in 164 cases totalling RUB 966.9 million, while 22 cases totalling RUB 40.3 million were denied.

Enforced collection in the reporting year was made under writs of execution totalling RUB 1,208.55 million, of which RUB 188.28 million (15.6%) was repaid. In the previous year, enforced collection totalled RUB 1,690.77 million, of which RUB 826.96 million (48.9%) was repaid.

The planned indicators of overdue debt repayment as of 1 January 2023 were fulfilled by 183.7%, which is RUB 705.8 million above the planned value. RUB 1,549.0 million was repaid against the plan of RUB 843.2 million.

As of 31 December 2023, the coverage of overdue debt by reduction actions is 96.5%. The low percentage of claim-related work coverage is explained by the presence of overdue debts under off-the-meter electricity consumption records included in the volume of electricity transferred under suspensive conditions for PJSC Astrakhan Electricity Retailer and PJSC Volgogradenergosbyt.

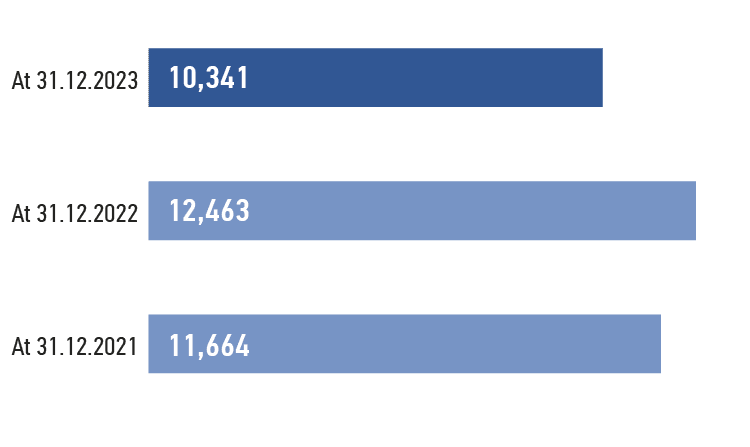

ACCOUNTS PAYABLE

IndicatorMetrics are aligned with financial statements of the Company for 2023, include the sum of the items “Other liabilities” 1450 and “Accounts payable” of the balance sheet (line 1520). | As of 31.12.2023 | As of 31.12.2022 | As of 31.12.2021 |

|---|---|---|---|

Accounts payable, including: | 10,341 | 12,463 | 11,664 |

suppliers and contractors | 4,920 | 8,085 | 8,047 |

bills payable | 0 | 0 | 0 |

advances received | 2,207 | 1,437 | 1,363 |

taxes and charges | 895 | 759 | 510 |

other accounts payable | 2,319 | 2,182 | 1,744 |

Accounts payable at the end of the reporting period are lower by RUB 2,122 million (17.0%) compared to the beginning of the year and amounted to RUB 10,341 million as of 31 December 2023.

The end of the year vs. the beginning of the year changes are listed below:

- Debt under the item “Suppliers and Contractors” is lower by RUB 3,165 million, with a decrease of RUB 1,670 million in investment activities, RUB 883 million in payments for services rendered by PJSC Federal Grid

Company – Rosseti, RUB 383 million in payments for energy retailers in terms of operating activities, and RUB 215 million in payments for losses - Debt on advances received amounted to RUB 2,207 million, which is RUB 770 million (53.6%) higher than as at 31 December 2022. This growth was mainly attributable to the advance payments received under the concluded grid connection agreements

- Taxes and levies payable as at 31 December 2023 amounted to RUB 895 million, which is RUB 136 million (17.9%) higher than at the end of 2022. The debt growth was mainly attributable to VAT and was driven by revenue growth

- Other accounts payable as of 31 December 2023 amounted to RUB 2,319 million and increased by RUB 137 million (6.3%) year-on-year due to the provision of funding worth RUB 107 million for energy saving projects. There was also an increase in lease obligations by RUB 217 million, in compensation of expenses for relocation of PTLs by RUB 63 million, in labour remuneration by RUB 58 million, in reduction of debts to non-budgetary funds by RUB 207 million, in penalties, fines and forfeitures by RUB 92 million, and in interest on third-party money by RUB 9 million.

BONDS

Type of security | Exchange-traded bonds |

|---|---|

Authority that assigned an identification number to the issue | Public Joint Stock Company Moscow Exchange MICEX-RTS |

Number of coupon periods, for which the yield on issued securities is paid: | Set by the terms of the issue |

Volume of the issued | Up to and including RUB 25,000 mln |

Status of the issue | Placement not yet started |

Maximum circulation term of the issue under the programme | No later than 10,920th day from the date of the placement of the issue of exchange-traded bonds under the programme |

Validity of the programme | Perpetual |

Issues under the Programme | Not placed |

Indebtedness as at 31 December 2023 | None |

No credit ratings were assigned to the Company in the reporting year.